-1.png)

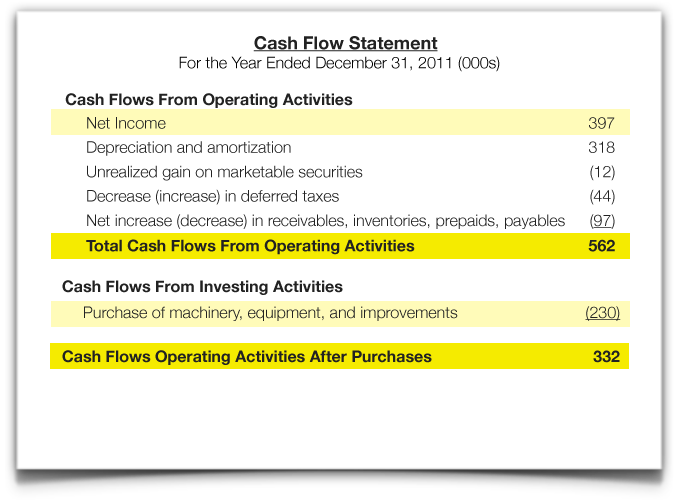

Impact of depreciation expense on cash flow statementĪs we have seen above, there is no direct impact of the depreciation expense on the cash flow statement. Therefore, after the adjustments to reconcile net income to net cash flows from operating activities that include the $5,000 depreciation expense and other changes in current assets and current liabilities, we have a result of $108,000 net cash flows from operating activities on the cash flow statement. Since the $5,000 of the depreciation expense charged to the income statement during the period is a noncash expense, we can prepare the cash flow statement starting from operating activities as below: Cash flows from operating activities Net income $100,000 Adjustments Depreciation expense 5,000 Increase in inventory (6,000) Decrease in accounts receivable 2,000 Decrease in prepaid expenses 5,000 Decrease in accounts payable (1,000) Increase in income taxes payable 3,000 Net cash flows from operating activities $108,000 What is the net cash flow from operating activities? Hence, we can present the depreciation expense on the cash flow statement as in the form below: Cash flows from operating activities Net income XXXX Adjustments Depreciation expense XXXX Increase in non-cash current assets (XXXX) Increase in current liabilties XXXX Net cash flows from operating activities XXXX Depreciation expense on cash flow statement exampleįor example, we have a $5,000 depreciation expense charged to the income statement during the accounting period and a net income of $100,000 on the income statement for the period.Īnd at the end of the accounting period, we have a reconciliation of the changes in the current assets and current liabilities as below: Changes in current assets and current liabilities Amount Inventory increase $6,000 Accounts receivable decrease $2,000 Prepaid expenses decrease $5,000 Accounts payable decrease $1,000 Income taxes payable increase $3,000 Likewise, when we prepare the cash flow statement, we need to add back the depreciation expense to the net income in order to arrive at the net cash flow provided by operating activities. However, as mentioned, the depreciation expense is a type of expense that does not involve a current cash outflow like other expenses.

and they appear on the income statement as the reduction to the net income.

Depreciation expense on cash flow statementĭepreciation expense is similar to other expenses such as utilities, office supplies, rent expenses, etc. This adjustment and other adjustments, such as changes in current assets and current liabilities, are required in order to convert the net income from the income statement to the net cash presented under the operating activities on the cash flow statement. In the preparation of the cash flow statement, the noncash expense will need to be added back to the net income as an adjustment under the operating activities section of the cash flow statement. Hence, depreciation expense on cash flow statement will be presented as an adjustment by adding it back to the net income in order to arrive at the net cash flow from operating activities. Likewise, there is no cash involved when we make the depreciation on the fixed asset.

In accounting, the depreciation expense that we charge to the income statement represents the cost allocation of the fixed asset that we have purchased. Depreciation expense on cash flow statement Introduction

0 kommentar(er)

0 kommentar(er)